Tuesday, November 30, 2010

Wall Street, investment bankers, and social good : The New Yorker

Wednesday, November 17, 2010

Swan Songs - NYTimes.com

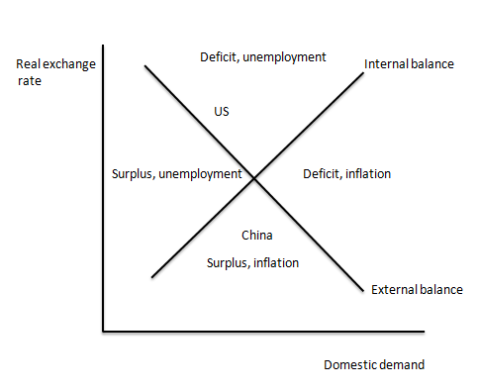

The best way to think about this sort of thing remains the Swan diagram, a half-century-old creation of the Australian economist Trevor Swan. He pointed out that, at minimum, economic policy has two instruments and two goals: the exchange rate and measures that affect domestic demand, on one side, and a sustainable balance of payments position and full employment without inflation, on the other. He then argued that you can usefully look at the state of an economy to get some idea of which policies are out of line — but that it’s not as simple as saying that a trade deficit means you need to devalue, or unemployment means you need more demand. Instead, the “zones of economic happinessunhappiness” are delineated as shown:

And I have, as you see, written in two major economies. Clearly — clearly! — China has an undervalued currency; you can tell this not simply from the fact that it has a trade surplus, but from the fact that it’s fighting inflation. The United States, which is fighting unemployment while suffering a large trade deficit, is in exactly the opposite situation — which is why it’s ludicrous to suggest that US QE and Chinese currency manipulation are equivalent.

And now China is considering price controls to help it maintain its undervalued currency. Bizarre, and disastrous for all of us.

Unsubstantiated Claims « Modeled Behavior

Unsubstantiated Claims « Modeled Behavior:

...the Fed for good reasons does not have a mandate to maintain a strong dollar. I wish I could devote more time to this. My wife says that we could clear up a lot of confusion by replacing strong dollar/weak dollar with fat dollar/skinny dollar. Then we could just say that the dollar is morbidly obese and millions of Americans would immediately think it a moral imperative to make the dollar lose weight.

Tuesday, November 16, 2010

Yglesias » The Generalized System of Preferences

America’s habit of charging tariffs on imported textiles is particularly egregious. Clothing represents a larger share of consumption for poor people than for the rich. Consequently, I think most people understand that if I were to propose a special sales tax on clothing it would be an unusually regressive tax measure. By levying the special tales tax exclusively on foreign-made clothing we don’t eliminate the negative impact on poor Americans. We do, however, shift around who benefits. By taxing only foreign-made clothing, government revenue (which at least finances many programs that are important to poor people) declines and instead many of the benefits are captured by the owners and managers of US-based textile firms. To make things even worse, politically powerful well-heeled people have generally managed to make it the case that luxury goods are taxed more lightly than things ordinary folks buy.

Long story short, dropping tariffs on imported textiles is one of the easiest and most effective things we could do to help poor Americans while also improving the prospects for economic growth in the third world.